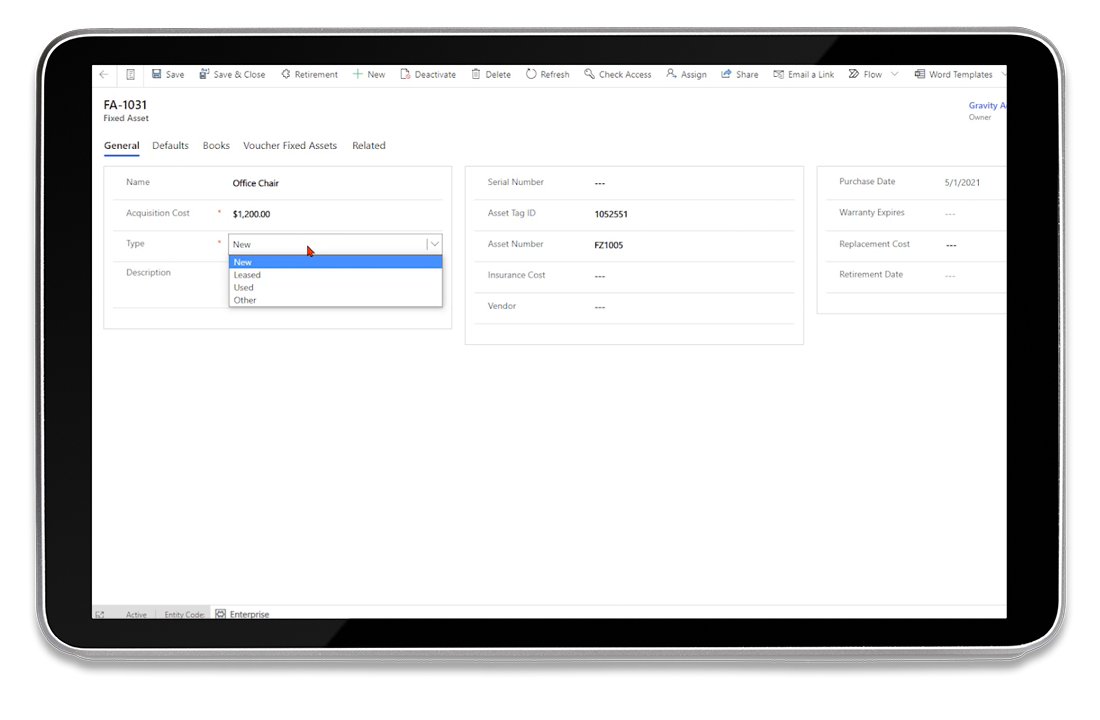

Gravity Software’s Fixed Asset Management is an advanced module built into our multi-entity accounting solution. Whether you're managing assets across a single entity or multiple locations, Gravity Software simplifies the complexity of asset tracking, depreciation management, and reporting.

As a complete cloud-based accounting software, Gravity Software ensures efficiency, accuracy, and tax-compliant depreciation tracking, all while seamlessly integrating with your existing financial systems. Whether you’re managing assets for a single entity or multiple locations, Gravity helps you stay organized, compliant, and on track across locations

Ready to see how Gravity Software can transform your fixed asset management?

Request a demo with Gravity to learn how our multi-entity accounting software can enhance your fixed asset management across multiple entities.