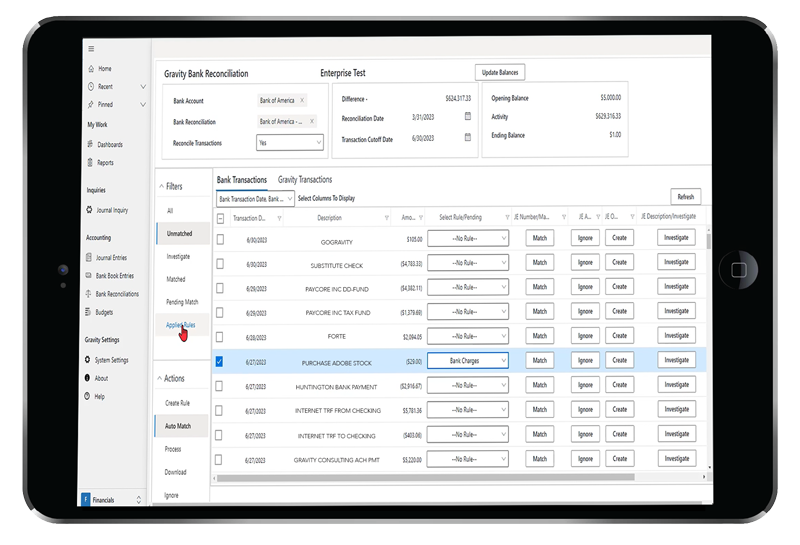

Streamline bank reconciliation with Plaid and Finicity integrations. Gravity Software's advanced accounting solution automatically imports bank transactions, helping you reconcile accounts with real-time, accurate data. Whether you're managing multiple entities or handling complex financial data, Gravity Software simplifies the reconciliation process, saving you time and increasing accuracy.

See how Gravity compares to leading cloud accounting solutions. Request a demo.

Streamline bank reconciliation with Plaid and Finicity for multi-entity accounting

Key features of Plaid and Finicity integrations

Integrating Plaid or Finicity with Gravity Software helps you streamline bank reconciliation by providing real-time bank transaction feeds and automating much of the manual reconciliation work. Here’s how it benefits you:

- Automatic bank feeds

Bank transactions are automatically synced with Gravity Software, reducing the need for manual data entry.

- Real-time reconciliation

Automate your bank reconciliation process with real-time updates. Plaid and Finicity provide accurate transaction data, ensuring that your financial records are always in sync.

- Customizable bank rules

Set up custom rules for categorizing transactions, streamlining your workflow, and reducing errors.

- Global bank support

Easily connect to domestic and international banks to consolidate your financial data from multiple accounts.

Want to see more?

After watching the Bank Matching Transaction Video, powered by Plaid or Finicity, explore our 7-minute demo highlights video to discover how Gravity's multi-entity accounting software can streamline your financial data aggregation and enhance your bank reconciliation process.

How the integration works with Gravity's multi-entity accounting software

Integrating Plaid or Finicity with Gravity Software’s multi-entity accounting solution ensures a seamless bank reconciliation process across multiple entities. Once you connect your bank accounts, the integration automatically syncs transactions, allowing you to:

- Effortlessly reconcile bank accounts for multiple entities.

- Ensure financial data is always up-to-date across your organization.

- Reduce manual errors and increase accuracy in your multi-entity reconciliation.

Ready to simplify your bank reconciliation process and improve financial data accuracy?

See how Gravity Software and Plaid or Finicity integrations can transform your financial workflows.

Resources to power your business

Explore these valuable resources, including guides, articles, and case studies, to discover how Gravity Software, powered by the Microsoft Power Platform and integrated with Plaid and Finicity, streamlines bank book management, automates financial workflows, improves bank reconciliation, and provides real-time financial insights. These resources will help you simplify your accounting processes, increase operational efficiency, and support the growth of your business.

Frequently Asked Questions

Curious about how the Plaid and Finicity integrations work with Gravity Software? This section addresses some of the most common questions and provides clarity on how these powerful integrations streamline bank reconciliation, enhance your financial workflows, and help you manage multi-entity accounting with ease. Whether you're new to bank data aggregation or already using these services, these FAQs will guide you through the setup and functionality.

What is the difference between Plaid and Finicity for bank integration?

Plaid and Finicity are both trusted financial data aggregation services, providing similar functionality, but Plaid offers a broader range of financial institutions, while Finicity focuses on fast, real-time transaction data aggregation. Both integrate seamlessly with Gravity Software to automate bank reconciliation and simplify financial workflows.

How does Gravity Software handle multi-entity bank reconciliation?

Gravity Software automatically syncs bank transactions across multiple entities, allowing you to easily reconcile accounts without the need for manual entry. By integrating with Plaid or Finicity, Gravity provides real-time data synchronization, ensuring accurate financial records for all your entities.

Can I use Plaid or Finicity for bank reconciliation across different countries?

Yes! Both Plaid and Finicity support a wide network of financial institutions across the US and Canada. This means you can easily connect to bank accounts in both countries and efficiently handle your multi-entity reconciliations in Gravity Software.

How do I set up Plaid or Finicity with Gravity Software?

Setting up Plaid or Finicity with Gravity Software is easy. Simply authenticate your bank accounts through the Plaid or Finicity integration setup. Once authenticated, Gravity Software will automatically sync transactions, streamlining your bank reconciliation process.

What types of transactions can I automate with Plaid or Finicity integration?

With Plaid or Finicity, you can automate the import of various bank transactions, including deposits, withdrawals, service fees, and more. These transactions are then directly recorded in Gravity Software, eliminating the need for manual data entry and speeding up the reconciliation process.

Is it possible to automate intercompany transactions with Plaid and Finicity integration?

While Plaid and Finicity automate the import of bank transactions for each individual entity, intercompany transactions can be easily managed using Gravity’s multi-entity accounting software. You can perform intercompany reconciliations by setting up journal entries between entities within Gravity.

How secure is the data transmitted by Plaid and Finicity?

Both Plaid and Finicity use secure, encrypted connections to protect your financial data during transmission. These integrations ensure that your data is safeguarded, complying with high standards for data protection and security.

Final thoughts: Plaid and Finicity integration for your business!

Plaid and Finicity integrations with Gravity Software allow you to streamline your bank reconciliation process, reduce manual data entry, and improve financial accuracy across multiple entities.

Get started today and see how automation can save you time and increase accuracy in your reconciliation effort