Why choose Gravity Software for Bank Book Management

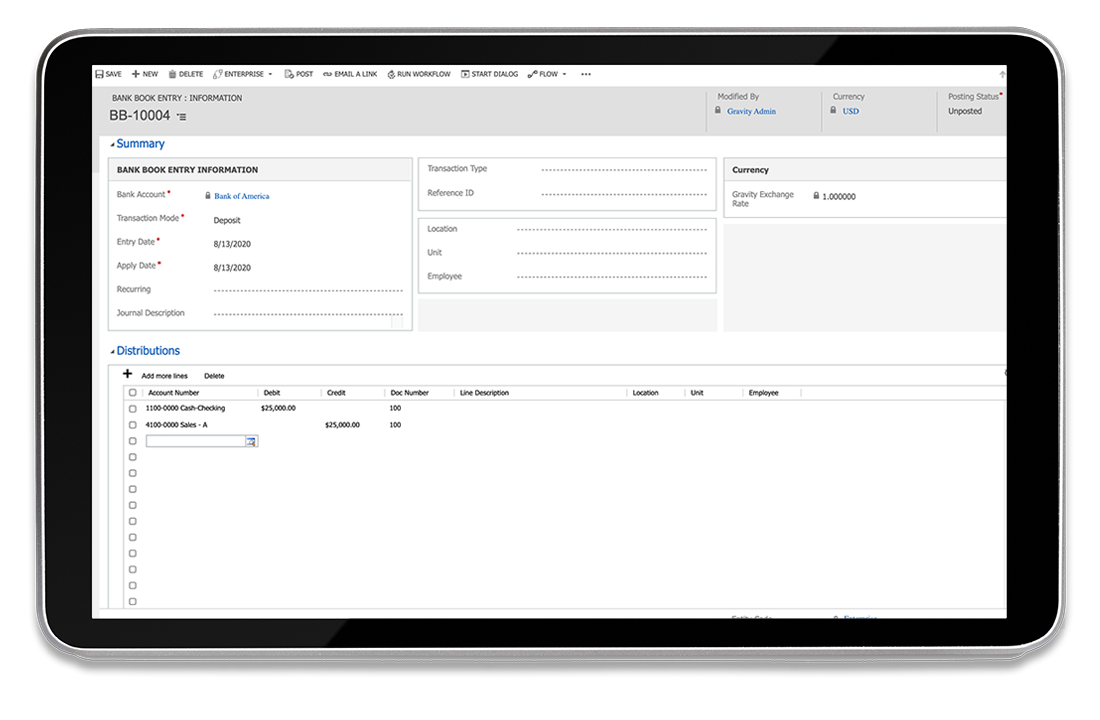

Gravity Software's Bank Book Management simplifies the way businesses manage their financial transactions across multiple bank accounts. Designed for small to mid-sized businesses, it centralizes and automates the tracking, reconciliation, and reporting of bank transactions, saving time and improving accuracy. With Gravity's seamless integration with financial institutions like Plaid and Finicity, businesses can sync real-time bank feeds and reconcile accounts—checking, savings, and credit cards—effortlessly.

For businesses with multiple entities, Gravity Software's Bank Book Management streamlines financial management across various business units, ensuring consistency and accuracy in your financial records. Whether you're managing one entity or multiple, Gravity provides a scalable solution that integrates easily with existing accounting systems, reducing manual data entry and preventing errors.

Work smarter, not harder

As your business grows, managing transactions across multiple bank accounts can become more complex. Gravity Software simplifies this with automated reconciliation and real-time transaction syncing, giving you better control over your cash flow and financial reporting. You can easily import bank data, update vendor information across multiple entities, and generate reports faster than ever, making financial management easier and more efficient.

Ready to Streamline Your Bank Book Management?

Experience how Gravity Software can improve your bank book management and help your business grow. Schedule a demo today to see how our automated reconciliation and real-time syncing—designed for businesses of all sizes and entities—can transform your financial operations.