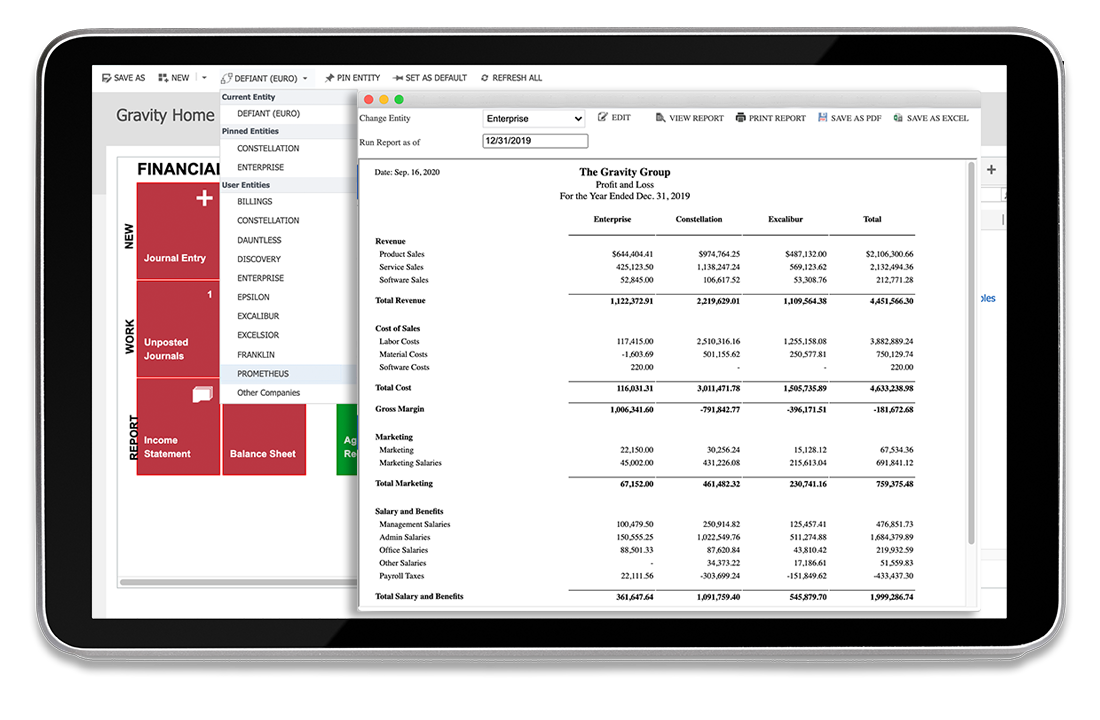

Effortlessly manage multiple companies, automate workflows, and consolidate financials with Gravity Software's multi-entity accounting solution, built on the Microsoft Power Platform.

Managing the financials of multiple companies, subsidiaries, or business units can be overwhelming. Gravity Software simplifies this by consolidating all of your entities into one powerful platform. Say goodbye to manual consolidations, disconnected systems, and the complexity of managing multiple databases.

Gravity Software helps you streamline your multi-entity operations while ensuring compliance, efficiency, and accuracy, no matter how many entities you manage.